Meme-Swarm and Microtrading

Franco “Bifo” Berardi

Other languages: Deutsch

As Year 2 of the Age of the Pandemic begins, the final battle between humankind and unfettered capitalism is turning ugly: the noose is tightening around our necks.

The privatization of everything has been the general trend of the last forty years. On September 11th, 1973, a Nazi murderer supported by Henry Kissinger overturned Salvador Allende and seized power in Chile, killing thirty thousand left wing militants along the way. Since then, the economy has been submitted to the Chicagoan advocates of the boundless pursuit of profit, with its programmatic slashing of worker salaries. So began the lasting era of Neoliberalism, premised on the Hitlerian doctrine of natural selection.

In the first month of the Year 2 of the Age of the Pandemic, Silicon Valley stages its final coup: the President of the United States of America (the same one Dorsey and Zuckerberg had served when he was a winner) is stripped of his right to speak.

The same month, Big Pharma seizes control of the life of the majority of the human species, reasserting the colonial privilege of the white race of predators over the Global South: vaccine nationalism announces its intention to utterly shatter an already-shaky geopolitical order.

Signs of chaos are everywhere: a fading liberal democracy is unable to halt the spread of low intensity global civil war between its conflictual identities.

Most recently, a new chaotic sequence has emerged in the field of finance, showing signs of potentially becoming a permanent factor of instability.

Genesis of the Swarm

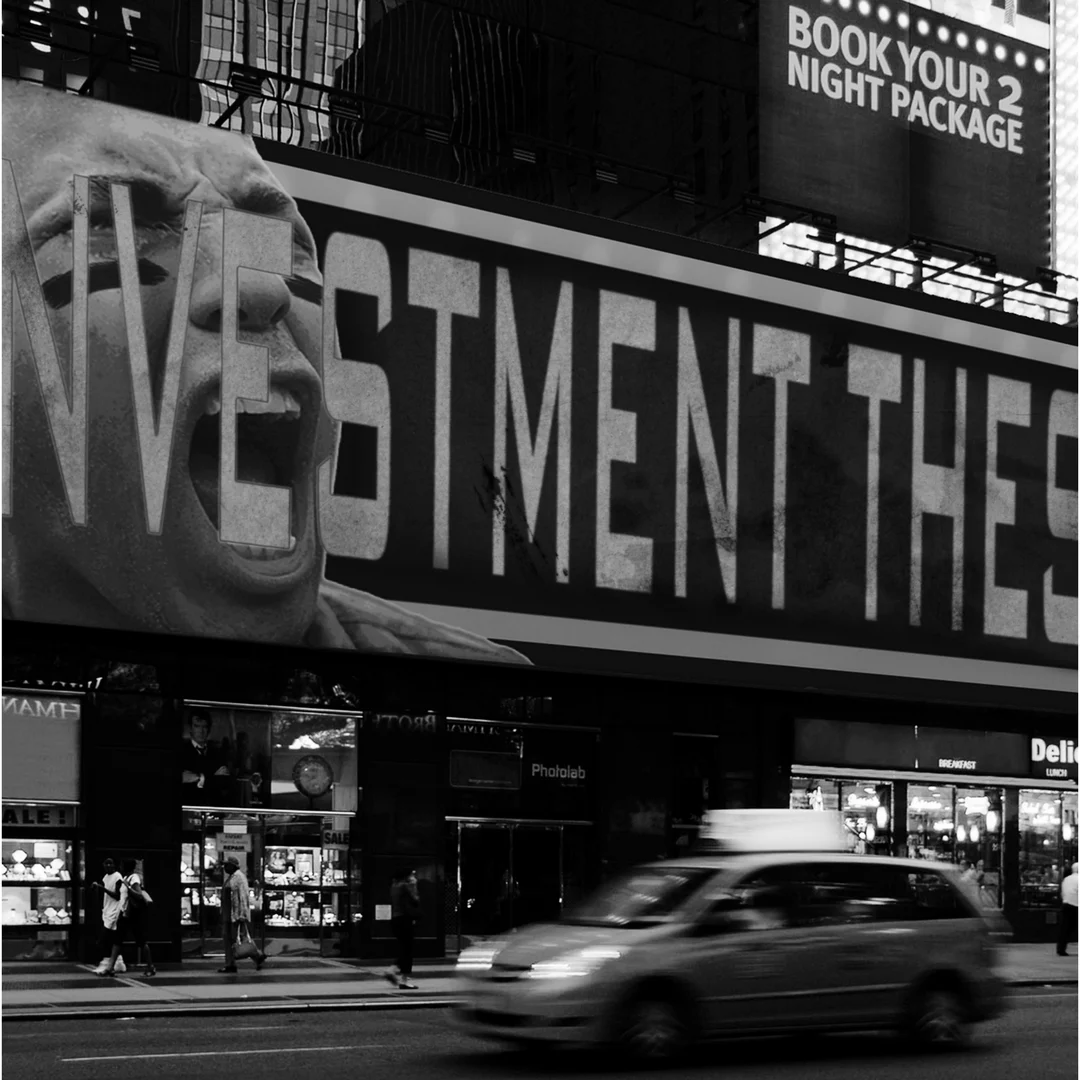

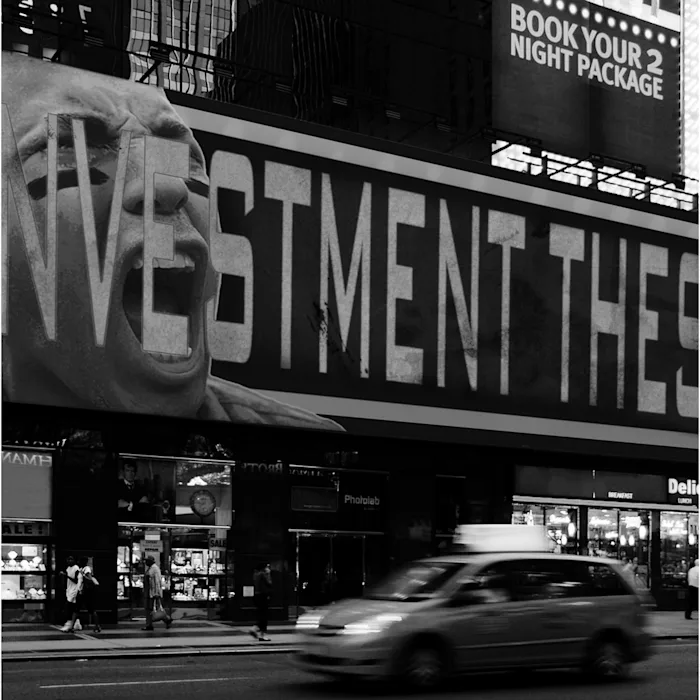

If I am especially interested in the work of the Barcelona-based artist Max Esteban, this is because, in addition to his work as an artist, he holds an MBA from Stanford University, a PhD in Economics and Business, and is an expert in matters of finance. Esteban is currently working on a project of visual critique of the financial madness that has been infecting the contemporary mind.

Twenty Red Lights (a video linked with three series of twenty photos each) is an attempt to visualize both financial dynamics and the effects that their domination has produced at the level of daily life and the social imagination: effects of panic, aggressiveness, and cynicism. As you enter the space of the exhibition you face three photographs: darkened corporate buildings, dimly lit windows of banks at night. Black, white, grey, a touch of blue, and red numbers of thirteen ciphers. Bank codes, passwords, cryptographs, proliferation of meaningless signs: dumbness and code. Accelerated noise, heightened blood pressure, deactivated empathy.

A Forest, the project that Esteban is developing now, is a video investigation about artificial intelligence and the nature of reality: are the images real? is the voice real? is our life real? Semiotic simulation has deeply transformed our perception of reality, and finance is a game based on semiotic simulation. Understanding the rules of the financial game is impossible, because those rules are constantly changing. These are not natural rules, but the effect of a never ending negotiation: a linguistic projection that is based on power.

Power is essentially defined as the imposition of rules of (linguistic) exchange. In fact, money and language have something in common: both are nothing, and yet move everything. Money is a sign without meaning. Meaning is defined by the potency of the act of language, and imposed by the force of the subject of enunciation.

In the last twenty years Christian Marazzi has repeatedly asserted that capital accumulation is more and more an effect of language. In Capital and Language, Marazzi explains that the volatility of financial markets should not be attributed to the discrepancy between the monetary-financial economy and the “real economy” (material goods produced and exchanged). The distinction between real and monetary economy disappeared in 1971 when Nixon cancelled the convertibility of the American dollar, thereby breaking the link between money and reality. Or rather, establishing a new order of so-called reality.

Nixon’s act abruptly disclosed the semiotic nature of money, paving the way to the free floating relation between sign and signified. Since that moment, the distinction between the “real economy” and the monetary economy ceased to apply: volatility in financial markets and dematerialization (or better, mentalization) of labor are merely two sides of the same coin. After 1971, the financial market ceased to be a representation of the “real” economy, or a monetary support for the needs of the “real” investors. The Stock Exchange has turned into a factory that creates money from nothing, that exchanges nothing for nothing, while generating real effects in the social distribution of wealth. The very concept of “reality” at that point became frail and uncertain and the relation between signifier and signified began to float:

Capital no longer belongs to the order of political economy: it operates with political economy as its simulated model… The reality principle corresponded to a certain stage of the law of value. Today the whole system is swamped by indeterminacy, and every reality is absorbed by the hyper-reality of the code and simulation. The principle of simulation governs us now, rather than the outdated reality principle (Jean Baudrillard)

What is the deciding factor in a regime of floating values? Who decides the price of an asset? Who decides the meaning of an enunciation when the relation between signifier and signified is aleatory? The answer is: force.

Since the fixed regime of exchangeability between signifier and signified was canceled and replaced by a regime of floating attribution of meaning the rationale of the financial market (and of the market in general) has been violence: the violent assertion of supremacy.

The 2008 financial crash was the effect of an accumulation of acts of monetary simulation — derivatives, credit default swaps and, on a larger scale, deficits and debt. All of a sudden the simulated construction crumbled and society was forced to pay the bill: impoverishment, precarity of labor, privatization of public services, and so on.

Debt was and is the linguistic device that forces humans to submit their life to exploitation.1

In the years that followed, the Occupy movement struggled for the emancipation of society from the imposition of debt, a linguistic injunction directly threatening social life. For this, it was brutally repressed and criminalized.

The Occupy movement was defeated because the streets are not the right place to fight an abstract enemy. A Molotov cocktail is not the right weapon for striking a floating, intangible target.

Ten years after the rise and fall of Occupy, we are now witnessing the emergence of a molecular financial class that is transforming the rebellion against the capitalist game into a vengeful participation in the game. This new molecular, fragmented financial actor is propelled by the dynamic of the swarm.

‘Swarm’ refers here to the automated coordination between the actions of a body governed by a techno-linguistic automaton. The swarm is a supra-individual organism resulting from the automated coordination of distinct individual organisms. By introducing techno-linguistic machines into the flow of connected communication, Semiocapital is transforming the living body of society according to the model of the swarm.

The Meme-Swarm in Action

Since the start of the pandemic, there has been an enormous increase in the number of retail traders.

Millions of unemployed people (mainly white men of different ages), adventurers and enraged libertarians, small businessmen out of business because of the lockdown and the ensuing economic disruptions spent their days buying, selling, trading and investing on the screens of their personal computers. As a result of these innumerable small individual investments, a huge amount of money poured into the financial machine, helping the stock market to survive the widespread depression.

These same amateur investors recently created havoc in the stock market by moving together in an irrational way, provoking waves of disorder in the trading process. Irrational exuberance is not a new thing in financial activity, but this time the exuberant actors are a multifarious crowd excluded from the circle of power. The swarm is their power, and the rule of the swarm is their rule.

This crowd of outsiders has been aided by the utter deregulation that the Trump administration oversaw in the financial field. As Doug Henwood observed:

It’s funny to see some Wall Streeters complain that there’s something unfair about this action, since these are the sorts of games they play with each other and the general public all the time. They talk up stocks or talk them down, depending on their interests, and plot against what they see as weak or vulnerable players all the time. It’s just that the amateur speculators with names like DeepFuckingValue who are savaging them for now are the wrong kind of people. They don’t live in Greenwich in houses with twenty-car garages.

Some three million people took part in the meme-swarm trading that fueled the GameStop breakout. The GameStop story is a tricky one: it’s based on the technicalities of the short-sell, a sort of sophisticated Ponzi-scheme that creates a bubble that at some point must predictably burst.

You can bet that the price of a stock will fall by taking on a short position. This requires you to borrow the stock from someone else first. Your broker then immediately sells the stock. Since you think the price will fall further, you’re calm, cool, and collected. You wait to the price to fall more, and then you buy the stock back at a lower price, so you can return the shares to whoever you borrowed it from.2

The GameStop event is particularly interesting because it’s been meme-powered. Traders have turned into a swarm thanks to semio-tribal structures of the Reddit and gamer community that lent them the force to stand against the established powers of the hedge funds. Memes are swarm-makers because they facilitate the construction of provisional identities, linking individual brains to a network-automated intention. The swarm is the automation of the activity of a collective body based on the self-reflexive brain activity of individuals, a phenomenon Brett Scott refers to as market surrealism:

[M]arket surrealism emerges, because it turns out that all those graphs that technical traders watch also reflect the actions of other technical traders. If traders are watching traders who are watching traders, rather than watching the company, the market lapses into a twilight zone.3

Techno-Financial Revenge

I think we should see the GameStop event as an episode of the ongoing American civil war. Civil war is taking on unprecedented forms in the networked world (hacking, network disruptions, etc.)

“This is a Financial revolution” is the title of an article published by the (not-so-crypto-)Trumpist magazine Zerohedge. Among many other media originating in the so-called ‘populist galaxy’, Zerohedge is giving voice to a rage that issues from a history of economic and social humiliation. The rage against the established powers of the financial elite is expressed in these words:

"It’s a class war. It’s time we fought back";

"There is and has been a ruling class whose sole purpose is to retain power. They gaslight us into thinking they know what is best for us. 1% knows better than 99%. This is not [about] stocks, this is a financial revolution…";

"The lesson is obvious: when we screw up, we pay the price for our mistakes. But when the banks screw up, the whole financial system comes to their rescue";

"Small investors have been fleeced for years. It’s infuriating. People are angry. We watched people burn buildings in the name of combating discrimination, others descend upon the US Capitol, others destroy people’s lives via Twitter, and yet others assaulting their fellow citizens who weren’t wearing masks."4

Of course, any attempt to blur or conflate the rebellion against the assassination of George Floyd with the trader assault on Wall Street is unjust and annoying, yes. The insurrectional movement that shook the country last May, like the Occupy Wall Street movement ten years ago, were attempts to provoke a process of recomposition of all exploited people against power. The micro-trading disruption, on the contrary, is a mere expression of the selfish proprietary instinct, and is aimed at hustling a bit of money and possibly some room in the Stock Exchange. But the point is clear: all segments of American society are waging war against all other segments.

So long as a segmented and identitarian selfishness prevails, so long as social solidarity is overshadowed by the propertarian instinct, the prevailing trend will be not social insurrection but civil war.

The Joker spirit is spreading, from Capitol Hill to Wall Street.

The culture of the fragmentary sub-financial class that is increasingly transformed into into swarms is not a culture of solidarity and social transformation, but one aimed at revenge (and possibly some cash).

One way to understand Trumpism is as a massive episode of revenge and humiliation on the part of a large segment of the American population that had seen its social mobility curtailed, its prospects humiliated, leaving its future radically uncertain. In his book Revenge Capitalism, Max Haiven retraces the roots of the current regression and the reactionary trend that is driving the world toward a new darkness. Its roots lie in humiliation and revenge. In 2016, the humiliated chose Trump because they (correctly) perceived him as the Humiliator in Chief.

Trump promised revenge by humiliation against Clinton, against Mexican people, and against Wall Streeters, among others. Now that the humiliator has been humiliated in turn, his followers are taking revenge against institutions like Congress and Wall Street. They do not expect victory, they do not expect change — they want only revenge. I quote again from Zerohedge:

This is personal for me, and millions of others. . . I’m making this as painful as I can for you […] That’s human nature: we do strange things when we’re angry. But it makes us feel better. […] But as the Reddit users say, it’s not about the money. It’s personal. It’s emotional.

And also:

They’re knowingly engaging in destructive (and self-destructive) behavior. They’re OK losing money, because they’re angry.

The Joker moment has come to the history of the world. The moment when mass production of psychosis jeopardizes the “normal” accumulation of capital. But the “normal” accumulation of capital is already a principal source of psychosis. So what’s next? Neoliberal capitalism has long been a hotbed of frustration: people were promised prosperity, reliability, even happiness, but all such neoliberal promises have turned out to be deceptions. The retail brokerage industry promises escape from daily misery by telling people (particularly white males) that they’re destined for market greatness and economic success. Another deceptive promise, just like all the others. However, it’s not too late for a bit of revenge.

(February 2021)

Images: Max Esteban, “Twenty Red Lights”

Notes

1. On this point, see Maurizio Lazzarato: The Making of Indebted Man, Semiotexte, 2012.↰

2. Alexis Goldstein, “What Happened with Gamestock?” Markets Weekly.↰

3. Brett Scott, “The real lesson of the GameStop story is the power of the swarm”, The Guardian.↰

4. “How does this all End?”, “This is a Financial Revolution”, Zerohedge.↰